19 September, 2023

Published: 19 September, 2023

Nitin Sharma on SaaS in India

Nitin Sharma, Co-Founder of Antler, the world’s largest venture builder, founded venture capital firms FirstPrinciples and Incrypt Blockchain. Nitin, a distinguished USC alumnus, is instrumental in advancing Antler’s global Web3 initiatives and serves on the USC Viterbi India Advisory Board.

Bullish Themes

- 34% of US stock market (growth?) comes from Tech. India has gone from 1 to 100+ unicorns in less than a decade. Most of these are not yet public and the rally is yet to come.

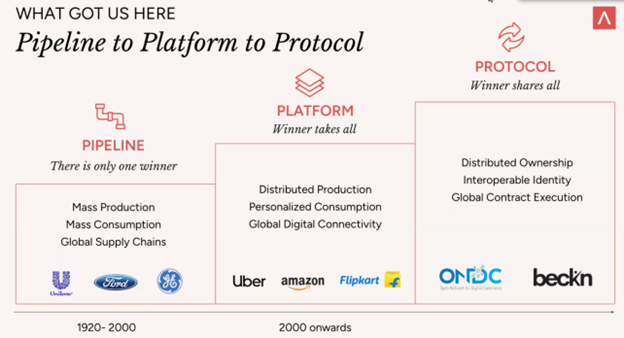

- Digital Public Infrastructure

- There is a gap between the large digitization of merchant payments and consumers, but low online sales … enter ONDC.

- 95% of content is English, but only 5% want to transact in English.

- Data democratization – Merchants can have access to their own consumer data and not lose that to a platform like Amazon.

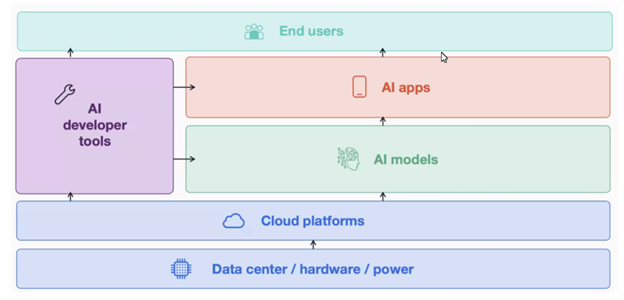

- Generative AI

- 1 of 3 ventures we review (2024, Q1) are GenAI based. Invested in 7 already.

- Klarna says its OpenAI virtual assistant does the work of 700 humans.

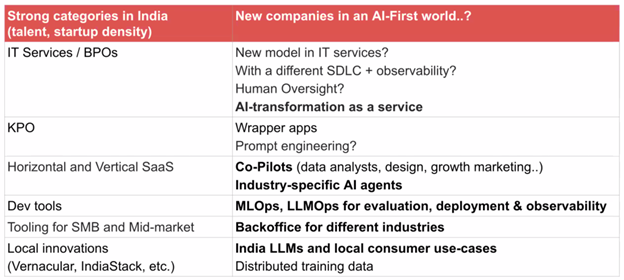

- Likely AI categories in India:

- IT Services: Even if BPO goes away, broader need for services does not go away. AI first companies that offer the same service but with far leaner are likely given existing power structures and

- IndicLLMs: Token density for Indian languages is much higher than English higher training cost. Lesser training data available and lesser monetary incentive to build these.

- Dev Tools

- Education

- AI4BHARAT – Artificial-Intelligence For Bharat

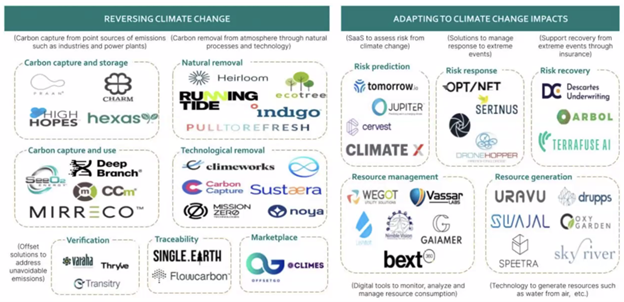

- Climate Tech

- Tech commercialization from university in India is not realizing its potential.

- Insurance and Financing for EVs in India is developing.

- UEI Standardized Charging - EV charging station: DPI platform in works to find closest EV charging spot, more

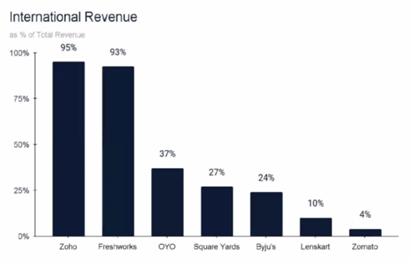

- SaaS

- SaaS in India today < Seattle’s SaaS industry. So 9a lot of potential.

- Indian products are moving from lower quality alternative to a higher quality and price positioning.

- Other “Green”shots

- India has the highest number of young people in the world, which will turn into the largest number of old people! Thus senior care is a potential market.

- Others:

- Mental health

- Sexual health

- FemTech

- Pet Care (growing affluent class)

- China + 1 –> Automation, digitization –> IoT, manufacturing SaaS

Miscellaneous

- Not bullish on Web3 in India. Rather look at Dubai or US.

- India is a low-trust society. Takes longer to build relationships.

- Incorporation – India vs US:

- Need US employee(s) – Then US, because they would not want Indian equity.

- If your business’ value proposition is IP – US has better laws.

- Wherever major revenue is coming from.

Published: 19 September, 2023